News

"Knowledge is power," a timeless saying that highlights the value of staying informed in our ever-changing world. Keep up to date and stay informed with highlights that might interest you.

Notice to Members: Our Banking System provider will be performing scheduled maintenance from approximately 11:00pm Saturday - 9:00am Sunday, October 26th. This update will intermittently affect ATM and POS (debit) transactions, however, Online Banking will be unavailable during the entire maintenance period. Thank you for your patience while we keep our systems up-to-date.

Phone Outage: Our service provider is currently experiencing technical issues with our main phone line. As a temporary workaround, please call us directly at 778-762-4647. We appreciate your patience while our vendor resolves the issue.

We know the Crofton Mill closure has brought challenges for many local families. If you've been affected, please connect with us so we can discuss the support options available to you. Visit any branch, call 1-888-899-2247 or 250-245-2247 or use our website chat to book your appointment.

"Knowledge is power," a timeless saying that highlights the value of staying informed in our ever-changing world. Keep up to date and stay informed with highlights that might interest you.

At LDCU, we're here to support you with accurate, easy-to-understand information. Our goal is to provide you with the financial insights and updates you need to confidently navigate today's economic landscape. Whether it's the latest news, helpful financial tips, or advice on managing your money, we're committed to offering content that not only informs but also makes your life easier.

Are you ready to make a lasting impact on your Credit Union? LDCU is seeking qualified, visionary members to join our Board of Directors. At our Annual General Meeting (AGM) on May 5, 2026, three director positions will become available. This is your opportunity to lead, collaborate, and guide the strategic direction of LDCU while representing the voice of our members.

Why an Effective Board Matters

The LDCU Board of Directors is elected by our members to provide oversight, ensure sound governance, and act in the best interest of our Credit Union. As the financial landscape evolves, we need experienced and dedicated leaders to navigate challenges and opportunities while protecting members’ assets.

What Does the Board Do?

The LDCU Board of Directors plays a crucial role in ensuring the Credit Union’s success and stability. Elected by members, the board is accountable for:

Who Are We Looking For?

We are seeking members in good standing who bring diverse expertise, perspectives, and a passion for our mission. Ideal candidates possess skills in one or more of the following areas:

Why Join the Board?

As a director, you’ll help drive innovation, growth, and member success. This is a chance to:

Ready to Make an Impact?

Director nomination packages are available on our website or in-branch. To be eligible, you must be a member in good standing.

Deadline: Completed nomination packages must be submitted by February 16, 2026.

Join us in shaping the future of LDCU and empowering our members through financial well-being. Together, we’ll build a stronger, brighter future.

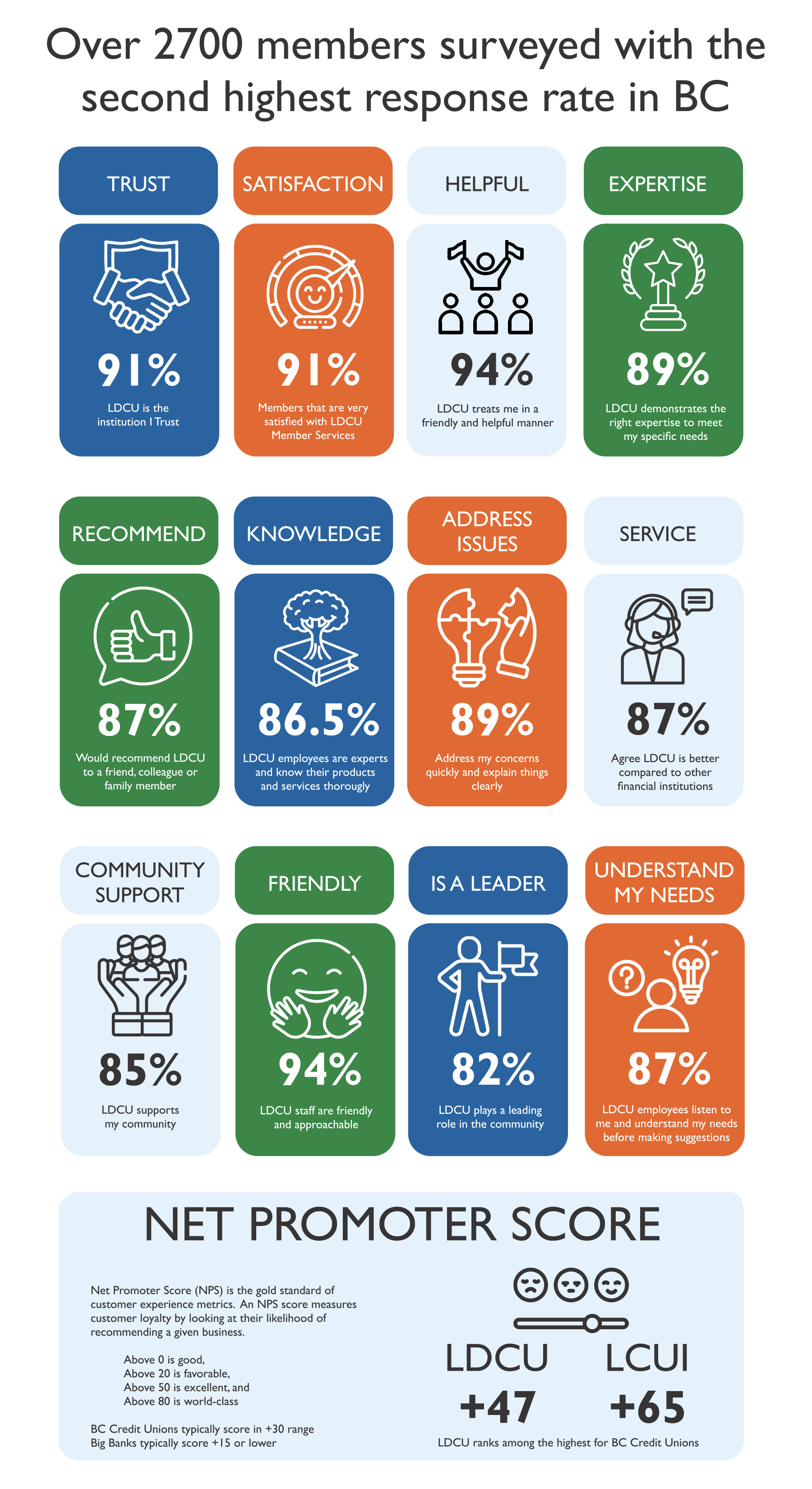

As the CEO of Ladysmith & District Credit Union, I am pleased to share the results of our recent customer service survey. Our members have consistently rated our service as excellent, which reflects our unwavering commitment to providing exceptional service and meeting your financial needs with care and professionalism. We value your trust in us as your financial partner and will continue to strive to exceed your expectations, ensuring a positive and rewarding experience with LDCU.

John de Leeuw - CEO.

"...LDCU has earned our Trust and Loyalty. Staff have always done their best to accommodate our financial needs at any one moment in time with due diligence and caring in a way that both parties receive 'Value for Money'..."

"I was greeted when I walked in. she attended to my needs right away. I left having a good feeling"

"Thank you for your services. I will consider moving some of my other banking to the LDCU"

"I appreciate that I have been able to have my questions answered over the phone while I was attending university in Ontario"

"Great place to bank Love the refresh at main branch, glad we have other location as well to serve us."

"I appreciate the local, friendly feeling from LDCU."

“Keep up the good work”

“Thank you for all you have done”

“Always given me the best coverages, best rates for my insurance needs. Even answer my annoying emails regarding homes issues, like woodstove guidelines, roofing coverage. This helps me plan and budget accordingly”

“They look after all my insurance needs. I have not dealt with any other insurance companies for almost 50 years”

“Very friendly staff and always answer questions and give us good insurance advice”

“Always available, proficient & efficient. Makes auto renewal very easy. Always provides cost of options and recommends the best rates “

Join Our Community and Connect with Us! We’re inviting you to join our social media community, where you can stay connected with all the exciting developments at our Credit Union. By following us, you'll gain access to a wealth of benefits and be part of a vibrant, supportive network.

Sunny can help answer your questions. Explore our helpful tutorials on bill payments, e-transfers, setting up text alerts, and using Deposit Anywhere™ for direct deposits - all available online to make managing your finances easier.

Looking ahead to the future, planning for retirement is crucial. At LDCU, we're here to help. Check out our retirement calculator on our website to easily estimate your savings needs and plan for a secure future.

Looking ahead to the future, planning for retirement is crucial. At LDCU, we're here to help. Check out our retirement calculator on our website to easily estimate your savings needs and plan for a secure future.